NAPA Political Action Committee

The National Association of Professional Appraisers (NAPA) Independent Expenditure Political Action Committee is a registered PAC. The political action committee acts to protect appraisers from over burdensome federal and state legislation and regulations.

Excerpt of Letter to the Massachusetts Legislature

Many real estate appraisers do not provide bank collateral appraisers

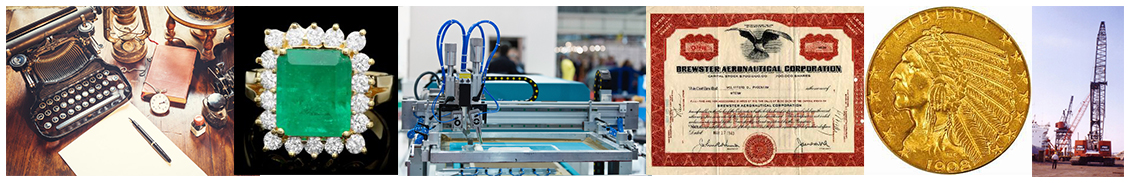

- How will Mass. Senate Bill 131 impact the supply of appraisers for technical valuations? There are a great number of court qualified expert witness appraiser whose special expertise is preparing reports and testifying about bankruptcy, decedent estate tax filings, gift tax, non-cash charitable donation, diminution in value caused by environmental issues, easements valuation, insurance underwriting segregated cost, wetlands issues, endangered species issues, Mass. Chapter 61A and 61B right of first refusal issues, Mass. Chapter 21E appraisals, legal title issues affecting value, assessment disputes, divorce, shareholder disputes, partnership dissolution valuations, and valuation of complicated business enterprise interest that includes real property.

- The courts, Daubert, and Lanigan decide whether a testifying appraiser is qualified to testify by his or her education, training, and experience Licensing does not raise the bar or in anyway provide additional protection to the public or consumers. The current state law, Chapter 112, was designed to implement FIRREA and the federal system of appraisals for mortgages. Making all appraisers subject to FIRREA and its myriad of extended state and federal banking regulations is not beneficial to the consumer.

Massachusetts Senate Bill 131 Does Not Provide “Consumers” With “Equal” Protection

- The Bill’s proponents argue that its purpose is to protect “consumers.” The Bill does not protect consumers because, the majority of license board complaints against appraisers are related to the appraiser’s use of a preprinted Form Appraisal Form. The residential home appraiser (one to four family) uses this appraisalform and form

filling softwar. The form appraisal was designed by Fannie Mae, Freddie Mac, and FHA for mortgage lending. These forms provides a significant amount of preprinted regulaory material mandated by lender/Fannie Mae/FHA requirements, all of which are lender requirements and do not relate to real estate appraisals for divorce, gift tax, or decedent estate tax filing, or the myriad of technical valuations involving easements, bankruptcy, government seisures, or environmental valuation issues.

- This form appraisal was not designed for consumers to understand its contents. The form appraisal does not protect consumers and was specifically designed to protect lenders. The form appraisal is not applicable to NON-Financial Institution federally regulated transactions. The typical residential appraisal report prepare under the current license law does not meet the generally accepted appraisal sandards for bankruptcy court, equitable division of marital assets, IRS decedent estate 706 tax returns, gift tax returns, or any of th many other applications of an independent professional appraisal.

- The form appraisal has preprinted “scope of work,” preprinted “definition of value”, “certification items”, all of which is directed toward use and protection for federally regulated lenders. The form appraisal report does not meet the needs (definition of value, intended user, scope of work) of a consumer filing for divorce, decedent estate tax returns, gift tax, environmental diminution in value issues, etc.

- The federal law that created real estate licensing requirement, known as the Financial Institutions Reform Recovery and Enforement Act (FIREA) was designed to protect banks, not consumers. Consumers who borrow money by mortgage are not protected by appraiser licensing. Consumers cannot order or pay for an appraisal under federal law. The consumer is never the client in a mortgage related appraisal. The client is always the lender. The Dodd-Frank Wall Street Reform and Consumer Protection Act in 2000 amended FIRREA. The law requires that lenders give consumers a copy of each appraisal or other estimate free of charge although a lender generally may still charge the consumer a reasonable fee for the cost of conducting the appraisal.

- The consumer is currently protected by the Consumer Financial Protection Bureau,the Truth-in-Lending Act, and Equal Credit Opportunity Act (ECOA) protects the borrowing Consumer regarding appraisals. All are directed at protecting the consumer from lender mischief.

- The Dodd-Frank Wall Street Reform and Consumer Protection Act (2010) § 1126 specifically prohibits banks from using broker price opinions in mortgage lending. Under federal law, the banks cannot use and do not use real estate broker opinions for mortgage financing.

- State Licensed real estate apprasiers have little or no training, experience or education in determinng the basis value for an IRS decedent estate 706 tax filings. This issue is important because an under valuation of property value for IRS reporting purposes can result in significant fines, penalties and possible disbarment for the appraiser under IRS Code § Section 6662. It also means the estate can be penalized 20% of the undervaluation. The heir to the property who submits an over valuation of his or her basis is subject to serious IRS penalties.

- The form generally known as Form 1003 is also titled URAR or Uniform Residential Appraisal Report. This form was created by Fannie Mae and approved by Ginnie Mae, and FHA. There is little thinking or analysis because the forms are filed automatically by software. The current forms including those used for Appraisal Review (critique) do not comply with USPAP Standard Rules.

- The Consumer Financial Protection Bureau announced in January 2013 that they were amending Regulation B, which implements the Equal Credit Opportunity Act (ECOA), and the Bureau’s official interpretations of the regulation, which interpret and clarify the requirements of Regulation B. The final rule revises Regulation B to implement an ECOA amendment concerning appraisals and other valuations that was enacted as part of the Dodd-Frank Act. In general, the revisions to Regulation B require creditors to provide to applicants free copies of all appraisals and other written valuations developed in connection with an application for a loan to be secured by a first lien on a dwelling

- The Consumer Financial Protection Bureau (CFPB) is supposed to prevent predatory mortgage lending and make it easier for consumers to understand the terms of a mortgage before finalizing the paperwork. It prevents mortgage brokers from earning higher commissions for closing loans with higher fees and/or higher interest rates, and says that mortgage originators cannot steer potential borrowers to the loan that will result in the highest payment for the originator.

- See Circular 230 naming appraisers as un-signing enrolled agents subject to penalties and disbarment when providing written information used by a taxpayer.